BHS collapse: Telford workers wait to hear when store will shut

Staff at the Telford branch of BHS were today waiting to hear when the store would close after administrators announced plans to liquidate the chain.

The department store is one of the largest retailers in Telford shopping centre, but is now to shut after the retailer's collapse earlier this year.

BHS has a total of 163 shops, which will now be subject to an "orderly wind down", said administrators Duff & Phelps.

That is expected to lead to 8,000 people being made redundant from within the store chain, and will place under threat a further 3,000 non-BHS employees who work for concessions within stores.

Telford's 37,500 sq ft branch is home to concessions of Wallis and Dorothy Perkins.

No official deadline has been set for the closures, which is instead dependent on the rate at which major assets are sold.

A spokesman said the timing of the closure of leased stores, such as the branch in The Border, one of the main routes into Telford Shopping Centre, would depend on the terms of their contracts with landlords.

The administrator added that BHS will be in "close-down sale mode" over the coming weeks.

Philip Duffy, managing director of Duff & Phelps, said: "The British high street is changing and, in these turbulent times for retailers, BHS has fallen as another victim of the seismic shifts we are seeing."

A spokesman for the shopping centre said: "We are extremely sorry to hear that BHS is to close and our thoughts are with the company's employees. BHS has always performed well in Telford as part of our vibrant and dynamic retail offer in fashion, food and homewares.

"With over 100 shops including four department stores, the centre trades extremely well with consistently high levels of footfall."

Alongside Primark and Marks & Spencer, the Telford branch is one of the biggest stores in the shopping centre, which has a total of one million sq ft of floorspace.

It is beside the currently-vacant ex-Asda store, which is being transformed to introduce more floorspace to the complex.

The collapse of BHS comes after bids to turn the business around in recent years failed.

Staff at the Telford branch of BHS would not talk about the announcement when contacted by the Shropshire Star.

It had been among the stores on which BHS had staked its future plans, when it became home to one of 19 food courts rolled out by the brand last year in a bid to revitalise the business.

Marks & Spencer has achieved great success with its food offering, which has performed well in the face of flagging clothing sales.

But the openings proved insufficient to rescue BHS from collapse, meaning that one of the biggest retailers at Telford Shopping Centre is to close its doors – although the centre is in the midst of an expansion programme intended on bringing in a number of new retailers, and extending its floorspace to 1.8 million sq ft.

The branch is also used as a thoroughfare for shoppers walking between Ash Grey Car Park and the Grange Central end of the centre.

BHS fell into administration in April, leaving behind a £571 million pensions black hole and sparking an investigation by MPs into its demise.

Attention will now turn to the role of previous owners, billionaire Sir Philip Green and former bankrupt Dominic Chappell, in the firm's collapse.

MPs are set to quiz both men in the coming weeks, with the Work and Pensions Committee pencilling in a hearing on the collapse for next Wednesday.

The pair have been roundly criticised – Sir Philip for paying a £400 million dividend to his family from the business, and over his management of the pension scheme, and Mr Chappell for sucking management fees out of BHS before its collapse.

Restructuring firm Hilco will now be tasked with helping liquidate BHS's store estate and remaining stock.

Former owner Sir Philip has said he is "saddened and disappointed" by the news.

A spokesman for the billionaire Topshop owner added that he had hoped to see the department store chain sold as a going concern.

Business Minister Anna Soubry said: "The announcement that the administrators have been unable to find a buyer for the business will be devastating news for all those who work at BHS and those in the supply chain. The Government stands ready to support workers to find new jobs as quickly as possible.

"The Business Secretary has already announced an accelerated Insolvency Service investigation into the activity of former BHS directors. Any issues of misconduct will be taken extremely seriously."

The news comes just days after administrators to Austin Reed said 120 stores would close after also failing to find a buyer for the business, resulting in the loss of approximately 1,000 jobs.

Dave Gill, of shopworkers' trade union Usdaw, said: "This news is a devastating blow for the staff and the shock waves will be felt on high streets throughout the country.

"There are some very serious questions that need to be answered, by former owners of the business, about how a company with decades of history and experience in retail has now come to this very sorry end."

There had been hopes that the business would survive as administrators entered last-ditch talks with a consortium led by Gregg Tufnell, a former Mothercare boss and the brother of ex-England cricketer Phil Tufnell.

The consortium, which includes banker Nick de Scossa and Jose Maria Soares Bento, registered a new firm called Richess Group Limited at Companies House earlier this month.

Duff & Phelps said: "Although multiple offers were received, none were able to complete a deal due to the working capital required."

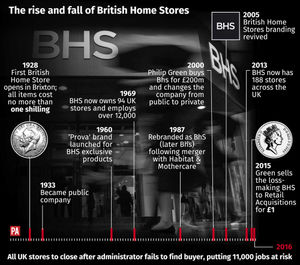

BHS was founded in 1928, selling all items for under a shilling, and expanded after the Second World War to employ 12,000 people across 94 stores.

In 2000 Sir Philip Green bought the store for £200 million, and two years later it became part of the Arcadia retail empire.

By 2005, however, cheaper rivals such as Primark were beginning to affect sales, and in 2015 it was sold to Retail Acquisitions, led by Dominic Chappell, for £1, in the hope of returning it to profit.