Farming Talk: Lending figure increasing for improvement

Funds loaned for farm improvements were nearly double in 2011 compared to 2010.

Funds loaned for farm improvements were nearly double in 2011 compared to 2010.

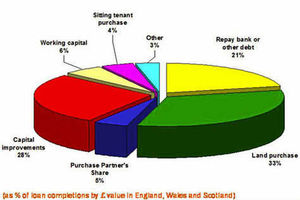

AMC figures are a good benchmark showing 28 per cent of all AMC loans completed in 2011 were for farm improvements, compared to 16 per cent in 2010.

This change has been driven by farmers and estate owners realising that current low interest rates, coupled with the very positive long-term outlook for UK agriculture, offer opportunities to invest in farm businesses in order to secure sustainable profits now and into the future.

Recent examples of capital investment projects in our region include putting in new buildings, milking parlours, improving grain or slurry storage, and farm-scale renewable energy projects such as wind turbines and solar energy systems.

Local farmers looking to invest in their businesses are being encouraged to act quickly to make the most of low interest rates and favourable capital allowances.

Most significantly the tax relief on investment in machinery and equipment is due to reduce in April 2012. The current tax allowances present a good opportunity for businesses wanting to plan any investments and be as tax-efficient as possible.

The continuation of low interest rates will also benefit those looking to invest, and securing finance as soon as possible will mean borrowers maximise the benefits of these low rates.

I would encourage farmers to take professional advice from their accountant on what is best for their circumstances sooner rather than later.

My colleague Trevor Sheard has been busy putting together business plans, which he says provide an essential key to securing finance.

Peter Wright, Partner in Balfours LLP and agent for AMC.