Revealed: The Shropshire towns where house prices are rising fastest

"If I could have 10 of all house types I could sell it all. That's just how the property market is at the moment."

That is according to one estate agent in the region who says a lack of housing supply continues to fuel record property prices.

Despite concerns that rising borrowing and living costs as well as inflation could impact buyer decision making, demand for properties in the region remains strong.

Simon Dodds, branch manager for Halls in Whitchurch, says: "If I could have 10 of all house types I could sell it all. That's just how the property market is at the moment in Shropshire, Mid Wales, the Midlands and the rest of the UK.

"There is just a massive stock shortage. Until stock, which is about 40 per cent down, increases to normal levels then prices will stay reasonably high."

It comes after two recent housing market reports found house prices in the West Midlands are still on the rise.

The average UK house price hit a record high of £276,759 at the start of 2022, according to Halifax's latest house price index. The West Midlands is significantly cheaper at £234,421 – up 9.6 per cent on the year.

Meanwhile, the latest Nationwide house price index showed that the wider housing market had made the strongest start to the year in almost two decades. Annual house price growth increased to 11.2 per cent in January, from 10.4 per cent in December.

The housing market has been through an unprecedented boom over the course of the pandemic. With the shift to flexible, remote and home working, homebuyers have rushed to buy larger properties in picturesque and rural locations outside of cities and large towns.

Mr Dodds says: "Prior to the pandemic the housing market, particularly in north Shropshire, was generally average – the number of transactions was fine, stock levels were great. It was just ticking over.

"Then obviously the pandemic kicked in. Once the Government said the market could start up again and agents could reopen that was the only thing people could do – you could buy and sell a house but you couldn't see loved ones.

"I think for those people who are local and are staying local they are just making sure when they retire they have a nice nest egg.

"Then there are other people who don't want to live in the city anymore or could work from home thinking they could come out of the cities and move to rural areas.

"There are also others realising what they could get for their money here. We just exchanged on a property where a couple moved up from Cambridgeshire. It was a similar sort of house – a cottage with land, which they sold for £1.5 million. They bought the same thing up here for half that price, so they have paid their mortgage off and the equity they got has bought this house. So they looked at it from the point of making themselves financially independent.

"Probably 60 per cent of our sales – what normally would have been about 75 per cent – are people that are local to the area, and the rest have relocated for personal or family reasons. There have definitely been more people who have moved into the area recently than in 'normal' times."

Other factors increasing homebuying were the government’s stamp duty holiday and historically low interest rates.

"There was a dormer bungalow outside Whitchurch on the market for £375,000 and the owner wanted to put it on for £390,000. We had offers of over £400,000. People had paid what they would have been paying on stamp duty and added it to the house to secure it. That started the sudden increase in property values," Mr Dodds says.

"We had about two years worth of transactions in a 12-month period. By the end of June 2021 we were running out of stock because so many transactions had gone through."

Mr Dodds says a rise in staycations in the UK also helped drive the thriving property market in rural areas.

"In July and August there was a little bit of a lull as people wanted to have a break and go on holiday. Staycations did very well in this country, including Shropshire.

"We have all explored areas which are within an hour of where we live a bit more because there was nothing else to do.

"So many people used to drive past Whitchurch, but now people think Whitchurch is great. There are some lovely pubs and restaurants as well as leisure facilities which people would have just bypassed before.

"Shrewsbury will always be popular and places like Ludlow will always do pretty well because of what it's like."

According to research from Savills using the Land Registry, the average second hand sale price in Shropshire for the 12 months to October 2021 was £271,416, compared with £202,793 in the 12 months to October 2016 – an increase of 33.8 per cent.

Peter Daborn, residential sales director at Savills in Shropshire, says: "What we have seen is a total shift in the market and people's buying priorities with the requirement of more space being in the most demand.

"It's worked well with places like Shropshire where there are lots of rural properties with more space and they are away from built-up areas.

"We used to refer to Shropshire as a 'hidden gem' whereas now I feel it has not as hidden as it used to be. It has definitely had a lot more coverage when talking about places to live."

Other research conducted by Savills has found places such as Diddlebury, Cound and Cardington are the most expensive areas in the county, with Madeley, Stirchley, Brookside, Hollinswood and Randlay in Telford among the least expensive.

"Villages on the fringe of Shrewsbury or Bridgnorth, that is where we are seeing the highest levels of demand as people are getting the best of both worlds. Villages such as Cound has got a fantastic community – you've got a cricket club, tennis club and all these bits and bobs, but you can still pop into town if you need it. In south Shropshire, such as the Clun area, houses have been doing as well as they ever have," Mr Daborn says.

Mr Dodds has described some of the prices properties have been making as "bonkers".

"Every agents, it has been a case of filling your boots really," he says. "People were outbidding each other and something we would have said was worth £400,000 was all of a sudden in the autumn of last year going for £500,000 plus. That is absolutely bonkers.

"In 2017 a modern, four-bedroom detached house in Whitchurch was on the market for £270,000. That same house has just sold for £350,000 – an £80,000 increase in five years.

"Three-bedroom semis, which were used stock and on the market for £150,000, were getting £50,000 more, executive four or five-bedroom houses which were perhaps £350,00 to £400,00 in 2017 were £500,000 at least and some were getting £600,000.

"We sold a new build in December 2020 and the lady who bought it from us was moving with her job 12 months later and we sold it for £140,000 more.

"It's the same with country cottages which were £250,000 five years ago are now selling for £450,000 plus five years later."

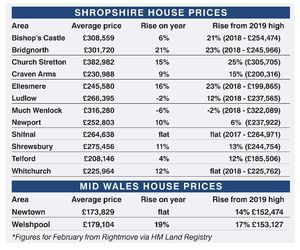

Data provided by Samuel Wood compares the cost of similar types of homes in different areas of the county.

Richmond Cottage, a two-bed, end of terrace property in Ludlow recently went on the market for £220,000, compared with 4 Bynner Street, a three-bed mid terrace in Shrewsbury which had a guide price of £190,000.

Garden Cottage, a three-bed, semi-detached property in Ironbridge was on the market for £390,000, compared with Halford Cottage, a two-bed, detached house in Craven Arms which had a price guide of £310,000.

Obiri House, a five-bed, detached home in Church Stretton was for sale for £675,000, compared with Chalfont, a six-bed detached home at The Mount in Shrewsbury which had a guide price of £900,000.

Russell Griffin, co-director of Samuel Wood and Midlands regional executive on the Propertymark Board, says: "Shropshire has certainly become one of the destination shires as thousands of families have relocated over the last two years.

"Here at Samuel Wood, we have experienced high demand in all our operational areas with Shrewsbury, Ludlow, Craven Arms and Church Stretton all experiencing significant house price inflation since the start of the pandemic. Prices saw an increase across most postcodes last year.

“Last year alone, here in Shropshire we experienced an 11 per cent increase year-on-year, compounding the demand driven by the pandemic."

As well as a big demand for properties in Shropshire, the housing market has also been strong in Mid Wales.

Tom Carter, managing partner and chairman of the property department at McCartneys which covers Shropshire and Mid Wales, says: "2020 was probably shaping up to be a reasonably year anyway pre-pandemic.

"There was a lot of natural, pent-up demand from people who would have done something anyway. In addition to that, we experienced this huge movement of people out of urban areas wanting to get out in the countryside on the back of being locked in towns and cities. It just fuelled the market.

"What we found was a huge demand and lack of stock which pushed prices up considerably in the first 12 months.

"The stamp duty holiday added fuel to the fire and a lot of people were trying to secure purchases before those holidays ended. What it allowed them to do was bid a little bit higher for the properties that they were interested in.

"The border areas are particularly popular with people if they are moving in from outside the area because they have the best of both worlds – the likes of Welshpool, Newtown, Montgomery and then running down the border and places like Knighton.

"Those are particularly popular because people are still in touch with their former life. If you have to spend time in an office for example, people can jump on the train and be in London in three hours or be in Birmingham or Manchester in an hour and a half.

"It is that balance of hanging on to that urban feel or that connection to urban areas for work or family, but living in places surrounded by glorious countryside."

A change in people’s habits and opinions on what they want out of their homes has also had a dramatic impact on the UK rental market.

"I know the interest rate is slowly creeping up and there is the current cost of living. It will make some people question whether it is a good time to sell and we should just stick with what we have got and stay where we are. But there are people out there who do want to move and want to sell at the height of the market and are willing to rent," Mr Dodds says.

"But that is another story as there is currently no rental stock. Loads of people trying to buy a house off us are in rented and they used to think they had the edge, but now it doesn't give you the same edge as it used to.

"They thought they would be in rented for six months, but 18 months later they are still renting. All of a sudden they will end up buying less of a house for the same money they sold their bigger house for. There's still going to be an issue with stock for at least the next six months I think. In reality I don't think there will be much of a correction this year or even next year."

As life begins to return to normal and the cost of living crisis skyrockets, experts are divided about how the immediate future of the market holds up – and when prices will finally drop for buyers.

"Until the stock levels go back to where they should be there will always been a demand on properties which will keep prices higher than perhaps they should be," Mr Dodds adds.

"There is currently a shortage of properties with land. We are seeing a few more family houses come on the market which is good, but there is also a lack of of smaller properties and affordable, first-time buyer properties. There are always a shortage of bungalows and amazingly a shortage of really big, quality houses worth £800,000 plus.

"At the moment if you put anything on the market it is like bees around honey, whether it is a property that needs doing up, a property for first-time buyers or a family house with a bit of land. There is just a massive shortage of all quality homes.

"Going forward who knows what will happen as we don't know yet what will happen around the world. There's a horrible thing bubbling away over in the Ukraine at the moment which is worrying on so many different fronts and could stop everything. That could suddenly turn the tap off and make people think they don't want to move with that going on. Suddenly the housing market could close and people could pull the plug.

"It's scary because if there is a crash how do we deal with it? I just hope it will soften rather than collapse."