Live: Chancellor Jeremy Hunt has delivered final Budget before general election

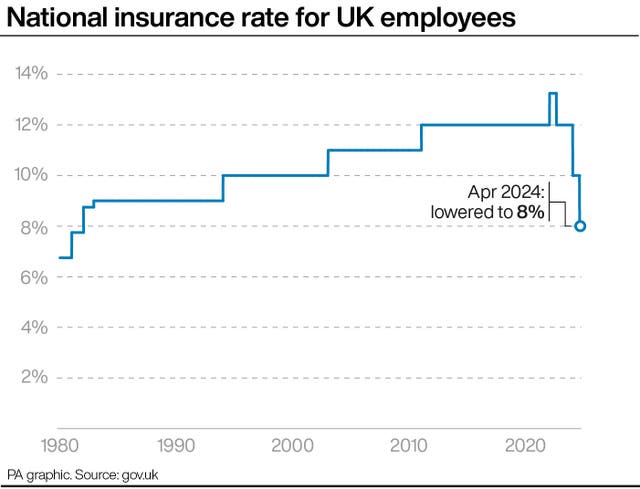

Mr Hunt confirmed a 2p cut in national insurance for employees and offered more help with child benefits for parents earning more than £50,000.

All eyes were on Jeremy Hunt today as the Chancellor delivered his Budget in the House of Commons.

Here’s the latest:

2.50pm

We’re closing our live coverage of the Chancellor’s 2024 Budget now. Thank you for reading.

2.43pm

Sir Keir Starmer accused the Government of “ducking their responsibility” to the victims of the infected blood and Horizon scandals, saying: “One of the greatest miscarriages of justice in our nation’s history – those were the Prime Minister’s words just two months ago – today justice kicked beyond the general election.”

The Labour leader said there is “no way to a calmer, less chaotic politics” with the Conservatives in power, adding: “Chaos is now their world view, a mindset that sees Britain’s problems as opportunities they can exploit.”

Sir Keir said the UK is a “nation in limbo” without a change of government, adding: “Britain deserves a government ready to take tough decisions, give our public services an immediate cash injection, stick to fiscal rules without complaint, fight for the living standards of working people and deliver a sustainable plan for growth.

“So we say to the Chancellor and Prime Minister, it’s time to break the habit of 14 years, stop the dithering, stop the delay and stop the uncertainty and confirm May 2 as the date of the next general election because Britain deserves better and Labour are ready.”

2.40pm

Sir Keir Starmer said “record levels of migration” have prevented an “even deeper decline”, telling MPs: “While on these benches we do not demean for a second the contribution that migrants make to a thriving economy, it is high time the party opposite was honest with the British public about the role migration plays in their economic policy.

“Because right now in terms of growth that is all they have. There is nothing else.”

The Labour leader said the cost of childcare is a “huge challenge for millions”, adding: “Parents need him to deliver on his promise, but it seems the Chancellor has been taking lessons on marketing from the Willy Wonka experience in Glasgow.

“All is not as it seems and with just over three weeks to go, he has to come clean because up and down the country parents need to know will they get their entitlement in April or is it just another of their reckless promises on governing? Headlines over delivery, promises without plans, policies that unravel at the first contact with reality.”

Sir Keir said the “Tory credit rating is zero”, adding: “It’s time for change with Labour.”

2.39pm

The Prime Minister is overseeing a “Rishi recession”, Sir Keir Starmer claimed, as he hit out at the Government’s record on the economy.

The Labour leader said it remains true that taxes are at “a 70-year high” despite the Chancellor’s budget, adding: “The British people paying more for less, an unprecedented hit to living standards of working people, the first time they have gone backwards over a Parliament, and they were cheering that today.”

“The reason is equally simple, there is no plan for growth. How can there be? He can say ‘long-term plan’ all he likes,” Sir Keir added to jeers from the Prime Minister and Chancellor.

He insisted it was a “statistical sleight of hand” by ministers to claim Britain has grown more quickly than countries like Germany over the last 14 years, telling MPs: “Indeed, in per capita terms, our economy has not grown since the first quarter of 2022, the longest period of stagnation Britain has seen since 1955.”

Sir Keir said: “There is nothing technical about working people living in recession for every second the Prime Minister has been in power. This is a Rishi recession.”

2.37pm

Sir Keir Starmer welcomed the Chancellor’s plans to improve NHS IT, and the fuel duty freeze, which he said Labour would support.

The Labour leader gave his backing to extra NHS IT funding, adding: “Although, I have to note that the Chancellor, when he was health secretary 10 years ago, promised to make the NHS paperless by 2018.”

He went on: “I know the Prime Minister’s fondness for Elon Musk extends to an enthusiastic embrace of his community notes on fact checking, so I will say this bit slowly, Labour supports the fuel duty freeze, that is our policy, and I look forward to the Prime Minister’s acknowledgement of that in coming days.”

Sir Keir urged Jeremy Hunt to ensure the saving was passed on to “hard-pressed families at the pump”.

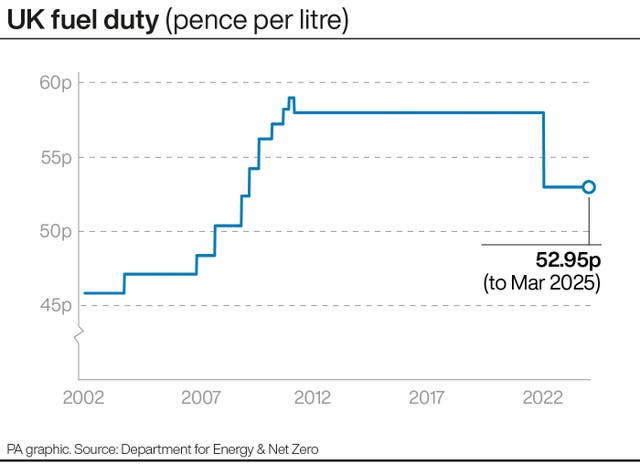

The Chancellor confirmed in his Budget that the 5p per litre cut implemented in March 2022 will be retained for another 12 months, and fuel duty will not increase in line with inflation.

2.36pm

Labour welcomed the cut to national insurance, but claimed Rishi Sunak had broken a promise to cut income tax.

Following his opening jibes after Jeremy Hunt’s budget speech, Sir Keir Starmer said: “Because we have campaigned to lower the tax burden on working people for the whole Parliament, and we won’t stop now, we will support the cuts to national insurance today.

“But I noticed this in 2022 when the Prime Minister was chancellor, he made this promise: ‘I can confirm in 2024 for the first time the basic rate of income tax will be cut from 20 to 19 pence’.

“Having briefed that all week, that an income tax cut was coming, that promise is in tatters today.”

2.35pm

Sir Keir Starmer has said the public will be subject to a “Tory stealth tax” through council tax increases.

The Labour leader told the Commons: “People have been living through this nonsense for 14 years. They know the thresholds are still frozen, dragging more and more people into higher taxes.

“They know that a Tory stealth tax is coming their way in the shape of their next council tax bill. The Levelling-up Secretary has told not just this House but every house in the country he’s coming for their council tax, give with one hand, Gove in the other.

“But most insultingly of all, the British people know the only cause that gets this lot out of bed is trying to save their own skin.

“Take the desperate move, after years of resistance, to finally accept Labour’s argument on the non-dom tax regime. Has there ever been a more obvious example of a Government that is totally bereft of ideas?

“And if they’re sincere in support of this policy now, then the question they must answer today is why did they not do it earlier? Why did they not stand up to their friends, their funders, and their family?

“Because if they had followed Labour’s example 3.8 million extra operations would have taken place by now, 1.3 million emergency dental appointments, free breakfast clubs for nearly four-and-a-half million children. But if instead this is just another short-term, cynical political gimmick then honestly what is the point of them?”

2.30pm

Angela Francis, director of policy solutions at WWF, said: “This budget is yet another missed opportunity to tackle the cost-of-living crisis and climate crisis.

“We know that importing polluting oil and gas is pushing up household bills and damaging the planet. Despite extending the windfall tax, government has done nothing to close the loopholes in it that give oil and gas giants huge tax write-offs.

“This is money which could be used to insulate homes, so families don’t have to choose between heating and eating, and to turbocharge cheap, clean British energy that will prevent us being hit by price spikes in the future.

“Choosing to prioritise the profits of fossil fuel companies, could cost us over £10bn a year and break the promise to phase out oil and gas subsidies the government made at COP28.

“If the Government is serious about creating more opportunity and more prosperity for the UK then it must invest in clean, cheap British energy which will reduce bills, grow our economy, and protect the planet.”

2.25pm

Sir Keir Starmer has said tax cuts in the Budget are a “Tory con”.

The Labour leader told the Commons: “If only it weren’t so serious, because the story of this Parliament is devastatingly simple: a Conservative Party stubbornly clinging to the failed ideas of the past, completely unable to generate the growth working people need, and forced by that failure to ask them to pay more and more, for less and less.

“And as the desperation grows they torch not only their reputation for fiscal responsibility but any notion that they can serve the county, not themselves.

“Party first, country second while working people pay the price.”

He added: “(The Conservatives) lost control of the economy, they sent interest rates through the roof, they made working people pay.

“They should be under no illusion. That record is how the British people will judge today’s cuts, because the whole country can see exactly what is happening here.

“They recognise a Tory con when they see it, just as they did in November. Give with one hand, take even more with the other.”

2.22pm

Tina McKenzie, the Federation of Small Businesses (FSB) policy chairwoman, said: “We welcome today’s increase in the VAT threshold as well as the cut to self-employed National Insurance Contributions (NICs).

“Elsewhere, we were pleased to see a package of small business support in the Budget documents, including commitments to make progress on the HMRC administrative burden and on the national roll-out of the Business Energy Advice Service, as well as extending the Recovery Loan Scheme under a new name – the Growth Guarantee Scheme. Small firms are crucial for economic growth, and we were glad the Chancellor has said that clearly from the despatch box.

“That said, many of those running businesses face serious challenges – not least through rapid hikes in labour and input costs – and many will have understandably hoped that there would be more measures announced today that would help ease the tough decisions small employers are having to make day-in day-out to keep their businesses going.

“There’s still a real gap when it comes to the crunch small firms are facing – and the growth, jobs and economic security small businesses provide is not something the country can afford to risk. While keeping the £5,000 Employment Allowance for the 10th year in a row is invaluable, it should have been uprated to keep pace with the National Living Wage – especially if employer tax thresholds remain frozen. Government must not be over-confident on jobs and hours in this economic environment.

“While more help with rising costs would have been welcome, we were pleased to see help for theatres and productions and fuel duty frozen again.

“As always, the devil is in the detail, and we will be examining the full range of measure. It’s not enough to just make ends meet – we need to make great leaps forward for the sake of the economy, and all the small business owners that operate within it.”

RECAP: Chancellor scraps non-dom tax exemption in Budget

Chancellor Jeremy Hunt used his Budget statement to announce the abolition of the non-dom tax exemption – robbing Labour of one of its longest-standing fiscal promises.

2.15pm

Shirley Widdop, a 56-year-old with physical disabilities which prevent her from working, said the Household Support Fund (HSF) has “helped her stay afloat” during tough financial times and she would be “at rock bottom” without it.

Ms Widdop, a former registered NHS nurse from Keighley, west Yorkshire, said she was “really pleased” to hear that Chancellor Jeremy Hunt had announced the extension of the HSF, which was due to wrap up at the end of March but will now continue until September, but she said the support “must continue” for longer.

The mother-of-three had claimed £140 on the HSF in October 2023 which helped to pay for her energy bill to heat her home, where she lives with her 19-year-old son who has autism among other conditions.

She told the PA news agency: “Without it, I would probably be hitting rock bottom financial-wise. There’s only so much money you can ask to borrow from your families without causing offense or upset and there’s only so much you can put on a credit card.

“The (HSF) helps you to stay afloat and you may be treading water, but at least you’re not dragged down into the depths.

“It was the right thing for the Government to do. I’m glad they’ve extended it but the Household Support Fund must continue, not just for the six months but further on from that.”

2.14pm

Tory MPs should expect to soon defend the Government on plans to remove private school tax relief following the Chancellor’s decision to axe the non-dom status, Sir Keir Starmer said.

Welcoming the move, which is a Labour policy, Labour leader Sir Keir said: “For those opposite now a little downbeat about another intellectual triumph for social democracy, I say get used to it, because with this pair in charge it won’t be long before they ask you to defend the removal of private school tax relief as well.

“The harder they try with cynical games like this, the worse it will get for them, because the whole country can see exactly who they are.

“Fighting for themselves, politics not governing, party first, country second.”

2.09pm

Scottish Tory leader Douglas Ross has said he is “deeply disappointed” at the extension of the windfall tax in the spring Budget, announcing he will vote against the measure.

Mr Ross, who also serves as an MP for Moray, had urged the Chancellor not to extend the levy, telling journalists it would not be the right move.

In a statement after the Budget was laid out in the Commons, Mr Ross said: “while I accept the Chancellor had some tough decisions to make, I’m deeply disappointed by his decision to extend the windfall tax for a further year.

“The SNP and Labour have abandoned 100,000 Scottish workers by calling for the taps in the North Sea to be turned off now.

“Although the UK Government rightly oppose this reckless policy – and have granted new licences for continued production in the North Sea – the budget announcement is a step in the wrong direction.

“As such, I will not vote for the separate legislation needed to pass the windfall tax extension and will continue to urge the Chancellor to reconsider.”

2.08pm

Sir Keir Starmer has referred to Prime Minister Rishi Sunak and Chancellor Jeremy Hunt as the “chuckle brothers of decline”.

He told the Commons: “The Chancellor, who breezes into this chamber in a recession and tells the working people of this country that everything’s on track. Crisis? What crisis? Or as the captain of the Titanic and the former Prime Minister herself might have said, iceberg? What iceberg?

“Smiling as the ship goes down, the chuckle brothers of decline, dreaming of Santa Monica or maybe just a quiet life in Surrey not having to self-fund his election.”

RECAP: Chancellor unveils 2p cut in national insurance as he delivers Budget

Chancellor Jeremy Hunt has announced a 2p cut in national insurance with effect from April, as he delivered his Budget. The move had been widely expected, as Downing Street tries to tempt voters before a general election later this year.

2.05pm

Sir Keir Starmer has accused the Conservative Government of “delusion” following the budget announcement.

The Labour leader told the Commons: “I mean over 14 years we have seen our fair share of delusion from the party opposite.

“A Prime Minister who thinks the cost of living crisis is starting to ease.

“An Education Secretary (Gillian Keegan) who thinks concrete crumbling on our children deserves her gratitude.

“A former prime minister (Liz Truss) who still believes crashing the pound was the right path for Britain.”

2.04pm

Sir Keir Starmer has branded the Chancellor’s Budget “the last desperate act of a party that has failed”.

Speaking in the Commons, the Labour leader said: “There we have it, the last desperate act of a party that has failed.

“Britain in recession, the national credit card maxed out, and despite the measures today, the highest tax burden for 70 years.

“The first Parliament since records began to see living standards fall, confirmed by this budget today.

“That is their record, it is still their record, give with one hand and take even more with the other, and nothing they do between now and the election will change that.”

2.03pm

Shadow chancellor Rachel Reeves has criticised Jeremy Hunt’s Budget, saying “it’s time for change” and calling for a general election.

1.57pm

Labour leader Sir Keir Starmer is on his feet responding to the Chancellor’s Budget.

1.55pm

On the Chancellor’s announcement of a further 2p National Insurance cut, IFS director Paul Johnson posted on X: “If you are going to cut income tax or NI then this is the right way to go.

“Helps working age people in work, reduces wedge between tax on earnings and other income, and helps work incentives (a bit).

“But. Overall tax has still risen a lot over this parliament. Low earners (under £25k) lose more from the frozen income tax thresholds than they gain from the NI cuts.”

1.54pm

Joanna Elson CBE, chief executive of Independent Age Chief, said: “Today’s Budget was a missed opportunity to help those in later life already living in financial hardship and address the incoming pensioner poverty surge. Cutting National Insurance won’t help the more than 2 million older people living in poverty, or the many more living with precarious finances struggling to make ends meet. Transformative change is needed to improve their lives.

“While the lower energy price cap and the increased State Pension are welcome, there is still a long way to go for older people in financial insecurity to be able to afford even the basics. Bills are still astronomically high, and our helpline hears daily from older people rationing themselves to just one meal a day and washing in cold water to save energy.

“The cost-of-living payments have ended and older people in financial hardship are already at breaking point. While the temporary extension of the Household Support Fund is welcome, long-term solutions are needed to protect them from high household costs. The UK Government needs to introduce a single energy social tariff and water social tariff. This would help shield people of all ages living on a low income, including older people, from high and unmanageable costs.

“Today, the UK Government reiterated its commitment to uprate Pension Credit, but it must now implement a strategic and targeted plan to get this money into eligible pockets. As the latest figures show that up to 880,000 households missed out, an uptake strategy is urgently needed to target those who need financial support but aren’t aware it exists or don’t know they are eligible.

“Pensioner poverty has been steadily rising since 2012. Sadly, nothing announced today will reverse this alarming trend. That’s why we need a cross-party review to establish an adequate minimum level of income needed to avoid poverty in later life. Until that happens, we risk seeing more older people fall into financial hardship.”

1.53pm

Councillor Adam Hug, leader of Westminster City Council, said: “The extension of the household support fund simply kicks the can down the road. It will mean little relief to thousands of hard hit Westminster families who need supermarket vouchers to get through the week.

“At Westminster we will tonight vote on a Budget which has a £21 million package of cost of living at its heart. We need long term planning, not temporary stop gaps. As it is, many households will find themselves teetering on a financial cliff-edge at the onset of winter.”

1.44pm

IFS director Paul Johnson has praised the Chancellor’s abolishment of the non-dom system that lets foreign nationals avoid paying UK tax on money made overseas.

Mr Johnson posted: “Wow – *abolishing* non dom regime. Removing outdated concept of ‘domicile’ and replacing with residence based system.

“Good. Lots of detail to see here.

“‘Flipping’ regime to encourage people to bring money here rather than providing the tax relief for income earned abroad.”

Mr Johnson also described Mr Hunt’s changes to child benefit charges as “radical”.

“Radical change this – allowing HMRC to collect household level information so as to reform high income child benefit charge,” he posted. “In short term threshold raised from £50k to £60k. Lose all child benefit only at £80k. This doubles period over which taper works so cuts marginal tax rates.”

1.43pm

Chancellor Jeremy Hunt has concluded his Budget speech, an hour and five minutes after standing up.

1.42pm

BREAKING: Chancellor Jeremy Hunt ended his Budget speech by saying the Government aims to cut national insurance further “when it can be achieved without increasing borrowing and when it can be delivered without compromising high-quality public services”.

1.40pm

Chancellor Jeremy Hunt, on non-doms, said: “Recognising the contribution many of these individuals have made to our economy, we will put in place transitional arrangements for those benefitting from the current regime.

“That will include a two-year period in which individuals will be encouraged to bring wealth earned overseas to the UK where it can be spent and invested here – a measure that will attract onshore an additional £15 billion of foreign income and generate more than £1 billion of extra tax.

“Overall abolishing non-dom status will raise £2.7 billion a year by the end of the forecast period, money the party opposite (Labour) planned to use for spending increases, but today a Conservative government makes a different choice. We use that revenue to help cut taxes on working families.”

1.39pm

Turning to taxes paid by those who are resident in the UK but not domiciled here for tax purposes, Mr Hunt told the Commons: “Nigel Lawson wanted to end the non-dom regime in his great tax reforming budget of 1988 which is where I suspect the Labour Party got the idea from.

“I too have always believed that provided we protect the UK’s attractiveness to international investors, those with the broadest shoulders should pay their fair share. After looking at the issue over many months, I have concluded that we can indeed introduce a system which is both fairer and remains competitive with other countries.

“So the Government will abolish the current tax system for non-doms, get rid of the outdated concept of domicile…”

As he was heckled by Labour MPs, Mr Hunt joked: “I aim to please all sides of the House in all my budgets. And will replace the non-dom regime with a modern, simpler and fairer residency-based system.

“From April 2025, new arrivals to the UK will not be required to pay any tax on foreign income and gains for their first four years of UK residency, a more generous regime than at present and one of the most attractive offers in Europe.

“But after four years, those who continue to live in the UK will pay the same tax as other UK residents.”

1.38pm

BREAKING: Chancellor Jeremy Hunt confirmed a further 2p National Insurance cut, from 10% to 8% from April 6, with self-employed National Insurance being slashed from 8% to 6%.

1.36pm

The high-income child benefit charge threshold will be raised from £50,000 to £60,000 and the taper will extend up to £80,000, Chancellor Jeremy Hunt has said.

1.35pm

The Chancellor’s announcement there will be an additional £2.5 billion available to the NHS in the coming year is “just enough to stop spending falling” and “not an increase on this year’s spending”, according to IFS director Paul Johnson.

Mr Johnson also criticised the extension of the Energy Profits Levy for another year to 2029, which Mr Hunt said would raise £1.5 billion, posting: “We need a stable regime. It is ludicrous adjusting this year on year to raise bits and pieces of money.

“There is a case for high taxes on these sorts of profits. Let’s have a stable regime.”

1.33pm

Turning to oil and gas, Mr Hunt said the Government will legislate in the Finance Bill to abolish the Energy Profits Levy “should market prices fall to their historic norm for a sustained period of time”.

He added: “But because the increase in energy prices caused by the Ukraine war is expected to last longer, so too will the sector’s windfall profits. So I will extend the sunset on the Energy Profits Levy for an additional year to 2029 raising £1.5 billion.”

1.32pm

Mr Hunt received cheers as he spoke of lower taxes, telling MPs: “If we want to encourage hard work, we should let people keep as much of their own money as possible.

“Conservatives look around the world at economies in North America and Asia and notice that countries with lower taxes generally have higher growth. Economists argue about cause and correlation. But we know that lower taxed economies have more energy, more dynamism and more innovation. We know that is our future too.”

Mr Hunt said he was confirming the introduction of an excise duty on vaping products from October 2026 in a bid to discourage non-smokers from taking up vaping.

Mr Hunt also said he would abolish the furnished holiday lettings regime.

He went on: “I have also been looking at the stamp duty relief for people who purchase more than one dwelling in a single transaction, known as multiple dwellings relief. I see the Deputy Leader of the Labour Party (Angela Rayner) paying close attention given her multiple dwellings. This relief was not actually designed for her but intended to support investment in the private rented sector. However, an external evaluation found no strong evidence that it had done so and that it was being regularly abused. So I am going to abolish it.”

He said he was going to reduce the higher rate of property capital gains tax from 28% to 24%, joking to Ms Rayner: “That one really is for Angela.”

1.31pm

BREAKING: Chancellor Jeremy Hunt confirmed he will abolish the non-dom system that lets foreign nationals avoid paying UK tax on money made overseas, replacing it with a “modern, simpler and fairer residency-based system”.

RECAP

Chancellor freezes fuel and alcohol duties for a year

1.26pm

BREAKING: Chancellor Jeremy Hunt confirmed the introduction of an excise duty on vapes from October 2026, a one-off increase in tobacco duty and a one-off adjustment to rates of air passenger duty on non-economy flights.

Protesters unimpressed with Budget

1.24pm

IFS director Paul Johnson has said the Chancellor’s plan to keep planned growth in day-to-day public spending at 1% in real terms will mean some public services having to be cut by a total of around £20 billion per year by 2028.

Mr Johnson posted to X: “Keeping planned growth in day to day spending at 1% (per annum) real over next parliament.

“Key point is that, with bigger increases nailed in for health, defence, and childcare, other public services will need to be cut – by (circa) £20bn (per annum) by 2028 on our calculations.”

1.22pm

Chancellor Jeremy Hunt, on his bid to make public services “more efficient”, said: “Police officers waste around eight hours a week on unnecessary admin – with higher productivity, we could free up time equivalent to 20,000 officers over a year.

“So we will spend £230 million rolling out time and money saving technology which speeds up police response time by allowing people to report crimes by video call and where appropriate use drones as first responders.”

Mr Hunt said £170 million would be used to fund “non-court resolution, reduce reoffending and digitise the court process”.

He also said £165 million would be invested over the next four years to increase the capacity of the children’s homes estate while £105 million over the next four years would be used to build 15 new special free schools.

1.19pm

Chancellor Jeremy Hunt said improvements will be made to the NHS so it can be used to confirm and modify all appointments, telling MPs: “On top of funding this longer-term transformation, we will also help the NHS meet pressures in the coming year with an additional £2.5 billion.

“This will allow the NHS to continue its focus on reducing waiting times and brings the total increase in NHS funding since the start of the parliament to 13% in real terms.”

1.18pm

Chancellor Jeremy Hunt said there is a need for a “more productive state not a bigger state”, saying: “I am keeping the planned growth in day-to-day spending at 1% in real terms. But we are going to spend it better.

“So today I am announcing a landmark public sector productivity plan that restarts public service reform and changes the Treasury’s traditional approach to public spending.”

On the NHS, Mr Hunt said the systems that support its staff are “often antiquated” before adding on the long-term workforce plan: “I wanted better care for patients, better value for taxpayers and more rewarding work for its staff. Making changes on the scale we need is not cheap. The investment needed to modernise NHS IT systems so they are as good as the best in the world costs £3.4 billion.

“But it helps unlock £35 billion of savings, 10 times that amount. So in today’s Budget for long-term growth, I have decided to fund the NHS productivity plan in full.”

He added: “We will slash the 13 million hours lost by doctors and nurses every year to outdated IT systems. We will use AI to cut down and potentially cut in half form filling by doctors. We will digitise operating theatre processes allowing the same number of consultants to do an extra 200,000 operations a year.

“We will fund improvements to help doctors read MRI and CT scans more accurately and quickly, speeding up results for 130,000 patients every year and saving thousands of lives, something I know would have delighted my brother Charlie who I recently lost to cancer.”

1.17pm

BREAKING: Chancellor Jeremy Hunt has said planned growth in day-to-day public spending will be kept at 1% in real terms but the Government will “spend it better” with a new “productivity plan”.

1.14pm

Chancellor Jeremy Hunt said AstraZeneca plans to invest £650 million in the UK to expand their footprint on the Cambridge Biomedical Campus and fund the building of a vaccine manufacturing hub in Speke in Liverpool.

Mr Hunt also joked he believes Education Secretary Gillian Keegan is doing an “F-ing good job” before saying he would be guaranteeing the rates that will be paid to childcare providers to deliver the Government’s offer for children over nine months old for the next two years.

On the armed forces, Mr Hunt said: “We are providing more military support to Ukraine than nearly any other country and our spending will rise to 2.5% as soon as economic conditions allow.”

1.13pm

BREAKING: Chancellor Jeremy Hunt promised to guarantee “the rates that will be paid to childcare providers” to deliver the Government’s free childcare expansion pledge.

1.12pm

Jeremy Hunt said Great British Nuclear will begin the next phase of the small modular reactor selection process, with companies having until June to submit their initial tender responses.

On creative industries, Mr Hunt said the Government will provide eligible film studios in England with 40% relief on their gross business rates until 2034.

He also said: “We will introduce a new tax credit for UK independent films with a budget of less than £15 million. For our creative industries more broadly, we will provide £26 million of funding to our pre-eminent theatre, the National Theatre, to upgrade its stages.”

On recognising the contribution to the creative industries and tourism made by orchestras, museums, galleries and theatres, Mr Hunt said: “In the pandemic we introduced higher 45% and 50% level of tax relief which were due to end in March 2025. It has been a lifeline for performing arts across the country.

“Today in recognition of their vital importance to our national life I can announce I am making those tax reliefs permanent at 45% for touring and orchestral productions and 40% for non-touring productions. Lord Lloyd-Webber says this will be a once in a generation transformational change that will ensure Britain remains the global capital of creativity.

“I suspect the theatre reliefs may be of particular interest to the shadow chancellor who fancies her thespian skills when it comes to acting like a Tory. The trouble is we all know how her show ends: higher taxes like every Labour government in history.”

1.10pm

One million pounds will be given towards the cost of building a memorial to honour the Muslims who died in the First and Second World Wars “in the service of freedom and democracy”, the Chancellor has said.

Jeremy Hunt told the Commons: “As we mourn the tragic loss of life in Israel and Gaza, the Prime Minister reminded us last week of the need to fight extremism and heal divisions.

“So I start today by remembering the Muslims who died in two world wars in the service of freedom and democracy.

“We need a memorial to honour them, so following representations from the Right Honourable Member for Bromsgrove (Sajid Javid) and others, I’ve decided to allocate £1 million towards the cost of building one.

“Whatever your faith or colour or class, this country will never forget the sacrifices made for our future.”

1.07pm

Chancellor Jeremy Hunt said he intends to reform the Isa system to encourage more people to invest in UK assets.

He said: “After a consultation on its implementation, I will introduce a brand new British Isa which will allow an additional £5,000 annual investment for investments in UK equity with all the tax advantages of other Isas.

“This will be on top of the existing Isa allowances and ensure that British savers can benefit from the growth of the most promising UK businesses as well as supporting them with the capital to help them expand.”

1.06pm

Chancellor Jeremy Hunt said new powers will be given to the Pensions Regulator and Financial Conduct Authority to ensure “better value” from defined contribution schemes by “judging performance on overall returns not cost”.

He said: “But I remain concerned that other markets such as Australia generate better returns for pension savers with more effective investment strategies and more investment in high quality domestic growth stocks.

“So I will introduce new requirements for DC and local government pension funds to disclose publicly their level of international and UK equity investments. I will then consider what further action should be taken if we are not on a positive trajectory towards international best practice.”

Mr Hunt said he will proceed with a retail sale for part of the Government’s remaining NatWest shares this summer at the earliest, subject to market conditions and value for money.

1.03pm

BREAKING: Chancellor Jeremy Hunt announced a new “British Isa” giving investors a £5,000 extra tax-free allowance to “encourage more people to invest in UK assets”.

1.02pm

Chancellor Jeremy Hunt said: “As a result of the decisions we take today, the Scottish Government will receive nearly £300 million in Barnett consequentials, with nearly £170 million for the Welsh Government and £100 million for the Northern Ireland Executive.”

Mr Hunt said there would be a long-term funding settlement for the future development corporation in Cambridge at the next spending review.

Mr Hunt also said the Government has reached agreement on a £160 million deal with Hitachi to purchase the Wylfa site in Ynys Mon and the Oldbury site in South Gloucestershire.

1.01pm

The director of the IFS has said the Chancellor’s pledge that borrowing will fall to 1.2% of GDP over the next five years should be taken “with a pinch of salt”.

He said it “will depend on implementing extremely tight spending plans which will imply cuts for many public services”.

12.59pm

Chancellor Jeremy Hunt took aim at Labour leader Sir Keir Starmer as he mentioned Surrey, noting: “I know he has been taking advice from Lord Mandelson who yesterday rather uncharitably said he needed to shed a few pounds – ordinary families will shed more than a few pounds if that lot get in.

“If he wants to join me on my marathon training he’s most welcome.”

Motoring groups welcome fuel duty freeze

Motoring groups have welcomed Jeremy Hunt’s decision to freeze fuel duty.

RAC head of policy Simon Williams said: “With a general election looming, it would have been a huge surprise for the Chancellor to tamper with the political hot potato that is fuel duty in today’s Budget.

“It appears the decision of if or when duty will be put back up again has been quietly passed to the next government.

“But, while it’s good news that fuel duty has been kept low, it’s unlikely drivers will be breathing a collective sigh of relief as we don’t believe they’ve fully benefited from the cut that was introduced just two years ago due to retailers upping margins to cover their ‘increased costs’.

“This has meant fuel prices have been higher than they would otherwise have been.

“What’s more, despite today’s positive news it’s still the case that drivers are once again enduring rising prices at the pumps, sparked by the oil price going up – the average cost of a litre is already up by more than 4p since the start of the year.”

12.56pm

Chancellor Jeremy Hunt said he will shortly publish draft legislation for full expensing to apply to leased assets, noting: “A change I intend to bring in as soon as it is affordable.”

He also told MPs: “I will provide £200 million of funding to extend the Recovery Loan Scheme as it transitions to the Growth Guarantee Scheme, helping 11,000 SMEs access the finance they need.”

Mr Hunt also said: “I will reduce the administrative and financial impact of VAT by increasing the VAT registration threshold from £85,000 to £90,000 from April 1 – the first increase in seven years.

“This will bring tens of thousands of businesses out of paying VAT altogether and encourage many more to invest and grow.”

Mr Hunt said a package of support potentially worth more than £100 million would be provided to the north east devolution deal.

12.55pm

BREAKING: Chancellor Jeremy Hunt has announced the VAT registration threshold will be increased from £85,000 to £90,000 from the start of April, saying it would help “tens of thousands of businesses.”

12.51pm

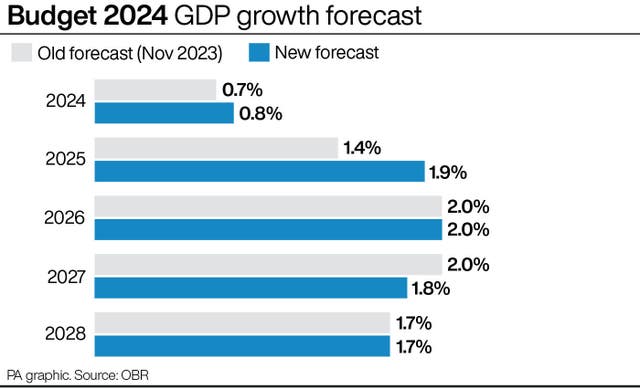

Chancellor Jeremy Hunt said the economy is expected to grow 0.8% this year and 1.9% next year, 0.5% higher than the OBR’s autumn forecast.

He said: “After that growth rises to 2%, 1.8%, and 1.7% in 2028.”

Mr Hunt also told MPs: “Because we have turned the corner on inflation, we will soon turn the corner on growth.”

Mr Hunt urged Labour MPs to listen to him as “they don’t have a growth plan”, adding: “Our plan is for economic growth not sustained through migration but one that raises wages and living standards for families.”

12.50pm

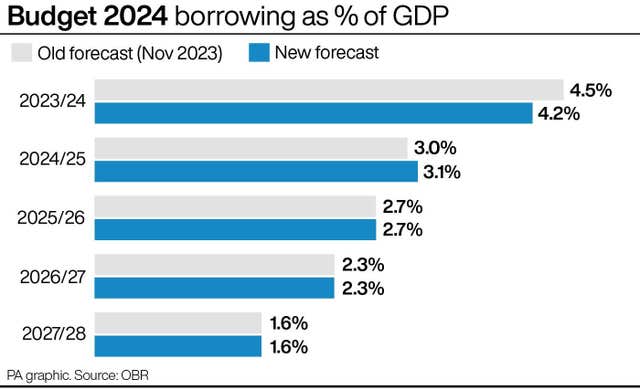

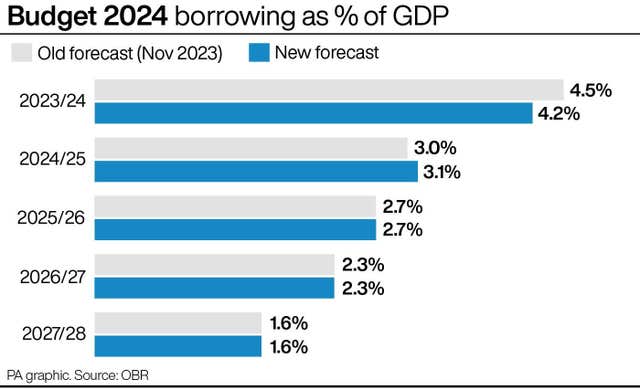

Chancellor Jeremy Hunt, on debt figures, said: “Underlying debt, which excludes Bank of England debt, will be 91.7% in 2024-25 according to the OBR, then 92.8%, 93.2%, 93.2% before falling to 92.9% in 2028-29.”

He added: “Our underlying debt is therefore on track to fall as a share of GDP, meeting our fiscal rule. We continue to have the second lowest level of government debt in the G7, lower than Japan, France or the United States.”

Mr Hunt went on: “We also meet our second fiscal rule for public sector borrowing to be below 3% of GDP three years early. Borrowing falls from 4.2% of GDP in 2023-24, to 3.1%, 2.7%, 2.3%, 1.6% and 1.2% in 2028-29. By the end of the forecast, borrowing is at its lowest level of GDP since 2001.”

The Chancellor claimed “none of that would be possible if Labour implemented their pledge to decarbonise the grid five years early by 2030”.

12.46pm

Chancellor Jeremy Hunt said he would maintain the 5p cut and freeze fuel duty for a further 12 months.

He said: “The shadow chancellor complained about the freeze on fuel duty and Labour has opposed it at every opportunity. The Labour Mayor of London wants to punish motorists even more with his Ulez plans. But lots of families and sole traders depend on their car. If I did nothing fuel duty would increase by 13% this month.”

Mr Hunt added: “I have as a result decided to maintain the 5p cut and freeze fuel duty for a further 12 months. This will save the average car driver £50 next year and bring total savings since the 5p cut was introduced to around £250.

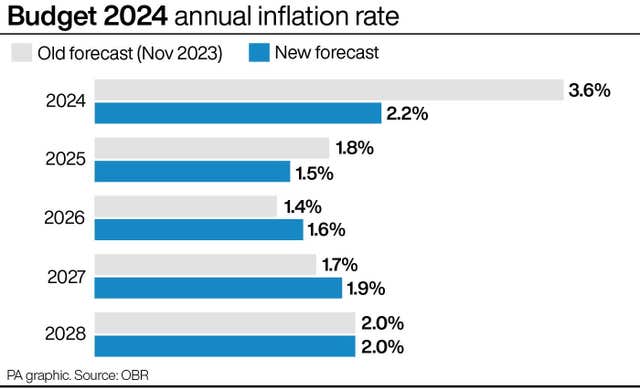

“Taken together with the alcohol duty freeze, this decision also reduces headline inflation by 0.2 percentage points in 2024-25 allowing us to make faster progress towards the Bank of England’s 2% target.”

12.46pm

Alcohol duties will remain frozen until February 2025, Jeremy Hunt said, with the aim of “backing the great British pub”.

The Chancellor told the Commons: “In the autumn statement I froze alcohol duty until August of this year. Without any action today, it would have been due to rise by 3%.”

He said he had listened to representations from MPs about the tax, adding: “So today I have decided to extend the alcohol duty freeze until February 2025. This benefits 38,000 pubs all across the UK – and on top of the £13,000 saving a typical pub will get from the 75% business rates discount I announced in the autumn.

“We value our hospitality industry and we are backing the great British pub.”

12.45pm

BREAKING: Chancellor Jeremy Hunt confirmed he has decided to maintain the 5p cut and freeze fuel duty for a further 12 months.

12.44pm

A fund aimed at supporting vulnerable households with the cost of living will be extended a further six months beyond March, the Chancellor said.

Jeremy Hunt told the Commons: “Next the Household Support Fund. It was set up on a temporary basis and due to conclude at the end of this month.”

He added: “I have decided that – with the battle against inflation still not over – now is not the time to stop the targeted help it offers. We will therefore continue it at current levels for another six months.”

12.43pm

BREAKING: Chancellor Jeremy Hunt announced the extension of the alcohol duty freeze until February 2025, benefiting 38,000 pubs across the UK.

12.42pm

Chancellor Jeremy Hunt said inflation is forecast to fall below the 2% target in a few months’ time.

He told MPs: “When the Prime Minister and I came into office, it was 11%. But the latest figures show it is now 4%, more than meeting our pledge to halve it last year. And today’s forecasts from the OBR show it falling below the 2% target in just a few months’ time, nearly a whole year earlier than forecast in the autumn statement.

“That did not happen by accident. Whatever the pressures and whatever the politics, a Conservative government, working with the Bank of England, will always put sound money first.”

Mr Hunt said he wanted to focus on people falling into debt, saying: “Nearly one million households on Universal Credit take out budgeting advance loans to pay for more expensive emergencies like boiler repairs or help getting a job.

“To help make such loans more affordable, I have today decided to increase the repayment period for new loans from 12 months to 24 months.”

Mr Hunt said a debt relief order can cost £90 and deter people seeking one, adding: “Having listened carefully to representations from Citizens Advice, I today relieve pressure on around 40,000 families every year by abolishing that £90 charge completely.”

12.41pm

The Chancellor said the Government was in a position to deliver “permanent tax cuts”, and billed his financial statement as a “Budget for long-term growth”.

Jeremy Hunt said: “Because of the progress we’ve made, because we are delivering the Prime Minister’s economic priorities, we can now help families not just with temporary cost-of-living support, but with permanent cuts in taxation.”

He claimed Conservatives know “lower tax means higher growth. And higher growth means more opportunity, more prosperity and more funding for our precious public services”.

Mr Hunt warned that growth could not come from “unlimited migration”, but from a high skilled, high wage economy, and claimed Labour’s plans for government would “destroy jobs with 70 new burdens on employers”.

He added: “Instead of going back to square one, the policies I announce today mean more investment, more jobs, better public services, and lower taxes in a Budget for long-term growth.”

12.40pm

BREAKING: The fiscal watchdog the Office for Budget Responsibility forecasts inflation falling below the 2% target in a few months’ time, Chancellor Jeremy Hunt said.

12.37pm

Mr Hunt said that because the Government is “delivering the Prime Minister’s economic priorities, we can now help families not just with temporary cost-of living-support, but with permanent cuts in taxation”.

12.36pm

Chancellor Jeremy Hunt began his Budget speech by saying he would allocate £1 million towards building a war memorial for Muslims who fought for the UK in past wars.

Mr Hunt said: “I start today by remembering the Muslims who died in two world wars in the service of freedom and democracy. We need a memorial to honour them, so following representations from the Member for Bromsgrove (Sajid Javid) and others, I have decided to allocate £1 million towards the cost of building one.

“Whatever your faith or colour or class, this country will never forget the sacrifices made for our future.”

12.34pm

Chancellor Jeremy Hunt is on his feet as he delivers his Budget speech.