Wage growth falls back further but continues to outstrip inflation

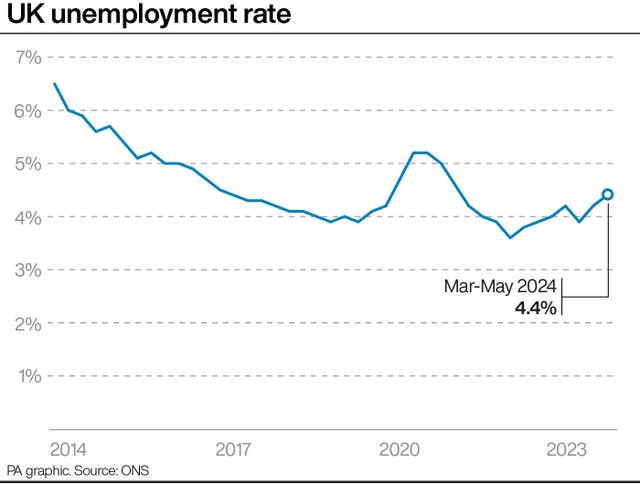

The ONS said average regular earnings growth dropped to 5.7% in the three months to May, while the rate of unemployment remained at 4.4%.

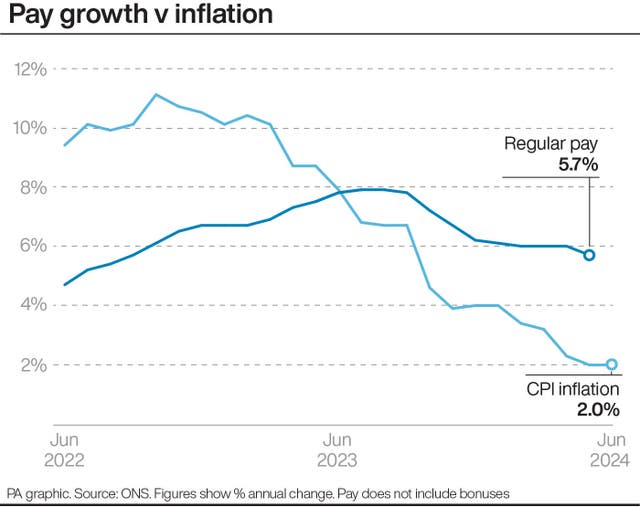

UK earnings growth has fallen back further amid mounting signs of a weakening jobs market, but wages are outstripping inflation at the fastest pace for more than two-and-a-half years, according to official figures.

The Office for National Statistics (ONS) said average regular earnings growth dropped to 5.7% in the three months to May – down from 6% in the previous three months and the lowest level since the quarter to September 2022.

With Consumer Prices Index (CPI) inflation taken into account, regular earnings rose by 3.2%, which is the highest since the three months to August 2021.

The ONS estimated that the rate of unemployment remained unchanged at 4.4% in the three months to May.

But it flagged further signals that the employment sector is cooling, with 30,000 fewer vacancies at 889,000 in the quarter to June, led by retail and hospitality.

Liz McKeown, ONS director of economic statistics, said: “Earnings growth in cash terms, while remaining relatively strong, is showing signs of slowing again.

“However, with inflation falling, in real terms it is at its highest rate in over two-and-a-half years.”

But she said there were “overall some signs of a cooling in the labour market”.

More timely figures also show that the number of workers on UK payrolls was estimated to have edged up by 0.1% month-on-month in June, up 16,000 at 30.4 million.

The ONS said growth in payroll employees has been slowing for at least the past six months.

Experts said the mixed data means the Bank of England’s decision on whether to cut interest rates is left hanging in the balance.

Policymakers are watching the jobs market, and wages in particular, closely as it weighs up when to cut interest rates from the current level of 5.25% on August 1.

Inflation has now fallen back to its 2% target, but despite the milestone, there are concerns that inflationary pressures still remain in parts of the economy.

Official figures on Wednesday showed inflation in the services sector – which accounts for more than three quarters of the UK economy – remained stubbornly high at 5.7% in June, partly as a result of wage growth.

While private sector regular pay growth fell to 5.6% in the three months to May from 5.9% in the previous three months, it stayed at 6.4% in the public sector.

Jake Finney, economist at PwC, said: “The latest labour market data continues to be more awkward for the Bank of England than the inflation data.

“The labour market is clearly cooling… but pay growth still remains elevated at 5.7%, way in excess of the circa 3% level that is considered to be consistent with the 2% inflation target.

“This still remains one of the largest potential barriers to an August rate cut.”

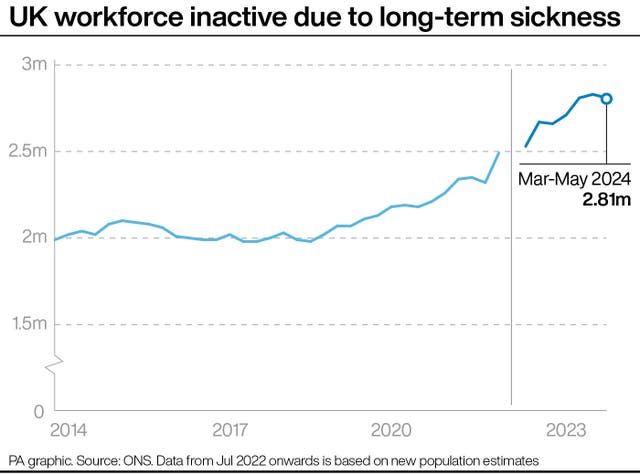

The ONS said the inactivity rate of those aged between 16 and 64 not actively looking for work edged lower to 22.1% in the three months to May, down from 22.3% in the previous three months.

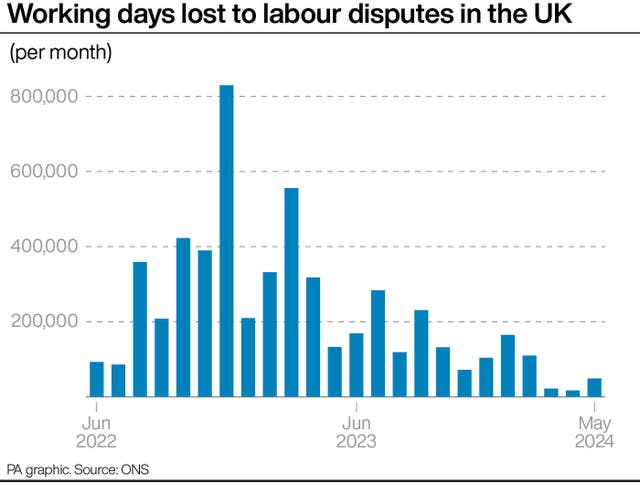

It added that there were around 49,000 working days lost due to strike action in May, marking the highest level since February.

New Work and Pensions Secretary Liz Kendall blasted the latest jobs market figures as “truly dire”, pointing to the 9.4 million people classed as economically inactive.

She said the UK was “standing alone as the only G7 country where the employment rate is still not back to pre-pandemic levels”.

“This is a truly dire inheritance which the Government is determined to tackle,” she said.

The ONS also announced separately on Thursday that the introduction of overhauled Labour Force Survey data would be delayed by at least six months, continuing the period of uncertainty over the figures.

The statistics body is revamping its jobs survey due to low response rates and had been hoping to launch the full revamped version in September.