Imposing VAT on private schools ‘wicked, stupid and cruel’, Government told

Peers have hit out at the plans which are set to come into effect in January.

A plan to impose VAT on private schools is “wicked, stupid and cruel”, Parliament has been told.

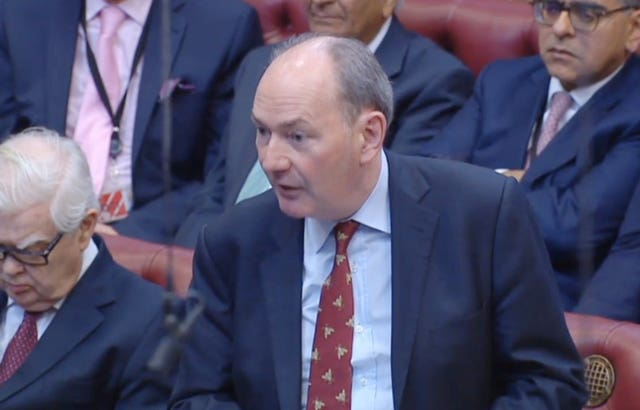

In strongly worded criticism at Westminster, Tory former Cabinet minister Lord Forsyth of Drumlean accused the Labour Government of pursuing “an ideological driven policy”.

From January, the Government plans to remove the VAT exemption and business rates relief for private schools to enable funding for 6,500 new teachers in state schools.

Currently, independent schools do not have to charge 20% VAT on their fees because there is an exemption for the supply of education.

But critics have warned over the short timescale involved and branded it a “blunt instrument” that risked unintended consequences, including the impact on children with learning difficulties who attend specialist independent schools and military families.

Lord Forsyth said: “I will sum up my view of this policy in three words: it’s wicked, it’s stupid and its cruel.”

He added: “Who in this chamber can defend the idea of sending a child halfway through term, suffering from autism, to another completely different environment.

“Anyone who knows anything about autism will know that would be a cruel and disgraceful thing to do and that is the consequence of this policy.”

Rather than the part of “education, education, education” under Tony Blair it was now one of “taxation, taxation, taxation”, he argued.

Lord Forsyth said: “I fear that this is an ideological driven policy of the kind the Prime Minister showed during the election when he was asked, ‘If one of your family were desperately ill would you ever use the private sector?’ and he said no.

“We don’t want that kind of politics in this country.”

Conservative peer Baroness Fraser of Craigmaddie, who has a child at a fee-paying school and a sister who teaches at one, said: “The draft Bill which has been published is to me a blunt instrument. It treats the sector as a homogeneous whole so causing unintended consequences.”

Tory peer Lord Lexden, who is president of the Independent Schools Association and secured the debate on the Government proposals, warned they would have “serious and far-reaching consequences” for the sector and that it was being imposed with “extraordinary haste”.

He said: “Acute concern has naturally arisen. Many parents are deeply worried. Many schools, particularly those of small size which account for the overwhelming majority in the independent sector, face an uncertain future.

“I stress one point above all – the effect that the rapid introduction of the tax will have on thousands of children, their wellbeing and their life chances. They should surely be at the forefront of our minds and our hearts during this debate.”

Independent crossbencher Lord Alton of Liverpool highlighted expert legal advice which argued the “education tax” could breach the European Convention on Human Rights (ECHR).

He said: “At the heart of this policy must be the impact on children. It clearly isn’t. This taxation is punitive, unjust, unfair, may be in breach of the ECHR and will worsen educational inequalities. For all those reasons I hope that the Government will think again.”

The Bishop of Southwark, the Rt Rev Christopher Chessun, said: “I am a grammar school boy and I could not sing the Eton Boating Song if you paid me yet I am deeply concerned about the adverse and unintended consequences which this manifesto commitment will have, unless applied with much greater sensitivity and possibly also to be phased.”

Conservative peer Lord Balfe said: “I agree that this was in the manifesto, but it’s still a very vindictive policy, and the way in which it’s being introduced actually worsens things.”

Labour peer Lord Hacking said: “It is immoral and destined to bring about significant social and political damage to my party and to the country.”

Tory peer Lord Lucas said: “What I’m most concerned about is the merciless decision to put VAT on in January to force children to move schools mid-year, in the middle of exam years, when there’s no chance to negotiate proper provision for special educational needs.

“I find it astonishing, given the years I’ve been here and the respect I have for the party opposite, that it should contemplate treating children with such cruelty.

“It really isn’t in the blood of the Labour party I know and I really hope they will think again and make the start date September.”

Conservative peer and historian Lord Roberts of Belgravia said: “This measure unfairly penalises those incredibly useful people in our society, namely parents who pay for their education twice, once in their taxes for other people’s children and once in school fees for their own.

“Instead of spending their money on luxuries, they invest in their children’s education.

“This is essentially a tax on those parental sacrifices and one that comes fraught with myriad unintentional consequences.”

Crossbench peer Baroness Butler-Sloss argued that people on “modest incomes” are being “attacked” by the policy.

The former top judge said she spent “all” her money on sending her children to private school, adding: “We didn’t take foreign holidays, things like that.”

Tory peer Lord Black of Brentwood said it was a “spiteful” policy based on “voodoo economics”, as he accused the Government of “heartlessly toying” with children’s education.

He added: “It is time to put children before party.”

Labour peer Lord Winston said the amount of money raised by charging VAT on private schools would be “trivial” in comparison to the sum needed to fix the “crisis in our schools”.

Responding, education minister Baroness Smith of Malvern said: “We are determined in Government to drive up standards in those schools for the overwhelming majority of the children in this country so that they may receive the opportunities which too often… have been the preserve of the rich and of the lucky.

“There has been an assumption from some contributors to the debate that only some parents have aspirations for their children.

“That is not something that is confined to people who choose to educate their children in private schools and are able to do that.”

She added: “Private education is not an option for most of those people and unlike the last Government we won’t build public policy around the expectation that public services will fail our children.”

Lady Smith stressed the VAT change would not impact on children with acute needs being educated in independent special schools, but promised to listen to concerns raised.

The Government would also “monitor closely” the impact of the policy change on military families, she added.