Grocery price inflation edges up as shoppers turn to promoted items

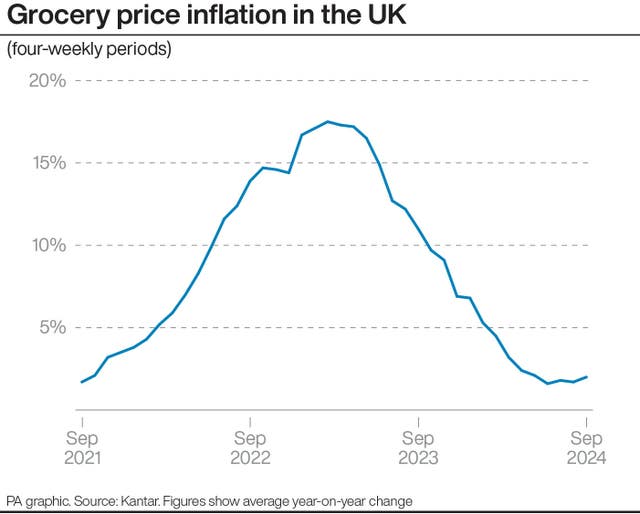

Analysis shows supermarket prices are 2% more expensive than a year ago, up from August’s 1.7%.

Grocery price inflation edged up again in September as households turned back to promoted items as they sought to manage finances, figures show.

Supermarket prices are now 2% more expensive than a year ago, up from August’s 1.7%, according to data from analysts Kantar.

Households responded by sending sales of promoted items up by 7.4% over the month while full price sales rose by just 0.3%. Overall take-home sales across the grocers rose by 2% over the same period.

Prices are rising fastest in markets such as chilled soft drinks, chocolate confectionery and skin care, while the average price paid for toilet and kitchen roll is 6% lower year-on-year, and dog and cat food are 4% and 3% cheaper respectively, Kantar found.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “In the fiercely competitive retail sector, the battle for value is on.

“Supermarkets are doing what they can to keep costs down for consumers and thanks to their efforts the prices in some categories are falling.”

The unusually wet weather in September saw hot chocolate sales surge by 28%, soup by 10% and home baking by 7%, while Halloween pumpkin sales nearly doubled on last September, at just under £1 million over the last four weeks.

With spending still stretched, more consumers are reporting that they are struggling to balance environmental concerns with their own financial worries, with 59% of Britons saying they are finding it harder to act sustainably, up from 44% last year, a survey for Kantar found.

Tesco gained its largest share since December 2017 to take 28% of the market, up from 27.4% a year ago.

Kantar’s figures show Asda’s sales are down 5.1% on a year ago to hold 12.6% of the market, while Morrisons sales are up by 2.8% to maintain 8.6% market share.

Ocado was the fastest-growing grocer for the eighth month running, with sales up 10% over the latest 12 weeks.

Spending through Lidl’s tills climbed by 8.8%, with the discounter adding 0.5 percentage points to take 8.1% of the market, while sales at Aldi accounted for 9.8% of spending across the grocers.