Reeves increases taxes by £40bn to address ‘black hole’ in public finances

Chancellor Rachel Reeves will also increase investment as she promised to ‘fix the foundations’ of the economy.

Chancellor Rachel Reeves set out a Budget which will increase taxes by £40 billion as she promised to “fix the foundations” of the economy and repair the public finances.

In the first Labour Budget since 2010 – and the first ever delivered by a woman – Ms Reeves promised to “invest, invest, invest”.

She promised billions of extra spending on schools and the National Health Service.

But she said the “black hole” left by the Conservatives requires tens of billions of additional taxes.

Ms Reeves claimed the scale of the public spending problems she inherited were worse than previously thought.

She said the £22 billion “black hole” left by the Tories in this year’s finances showed they “hid the reality of their public spending plans”, with problems recurring in future years.

Ms Reeves also promised to set aside £11.8 billion to compensate those affected by the infected blood scandal and £1.8 billion to compensate victims of the Post Office Horizon scandal.

The Chancellor said: “Together, the black hole in our public finances this year, which recurs every year, the compensation payments which they did not fund and their failure to assess the scale of the challenges facing our public services means this Budget raises taxes by £40 billion.

“Any Chancellor standing here today would face this reality. And any responsible Chancellor would take action.

“That is why today, I am restoring stability to our public finances and rebuilding our public services.”

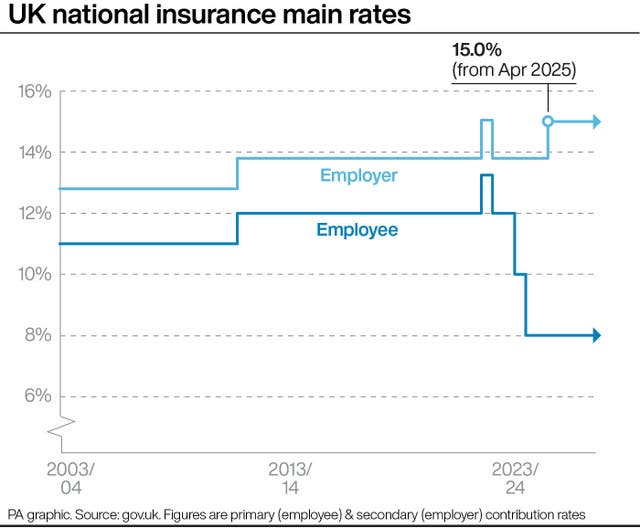

She confirmed a £25 billion raid on employers’ national insurance contributions, with higher rates and a lower starting threshold.

The rate will increase by 1.2 percentage points to 15% from April 2025, with payments starting when an employee earns £5,000, down from the current £9,100.

“I know that this is a difficult choice. I do not take this decision lightly,” Ms Reeves said.

The Chancellor announced a £2.5 billion increase in capital gains tax by increasing the lower rate from 10% to 18% and the higher rate from 20% to 24%.

She also confirmed changes to inheritance tax, including bringing pension pots within the tax from April 2027, and reforms to agricultural and business property reliefs, raising a total of £2 billion a year.

Ms Reeves, who stressed she was committed to helping “working people”, promised to end the freeze on income tax and national insurance thresholds.

As earnings increase, maintaining the threshold freeze would have seen more people dragged into paying tax or shifted into higher bands.

“From 2028-29, personal tax thresholds will be uprated in line with inflation once again,” she said.

“When it comes to choices on tax, this Government chooses to protect working people every single time.”

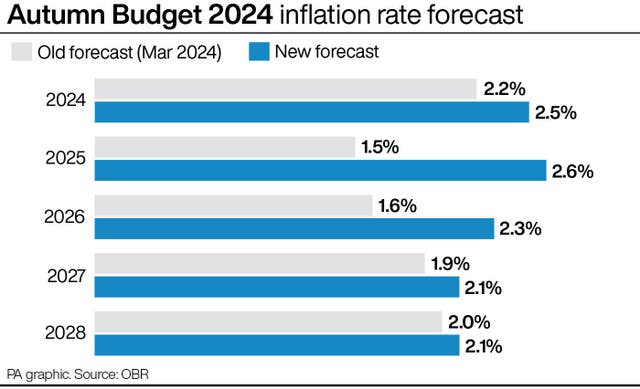

The Office for Budget Responsibility’s forecast suggested gross domestic product growth will be higher in 2024 than expected in March – upgrading it from 0.8% to 1.1% and from 1.9% to 2.0% in 2025.

But there are downgrades in subsequent years – down from an expected 2% in 2026 to 1.8%, from 1.8% in 2027 to 1.5% and from 1.7% in 2028 to 1.5%.

Borrowing is expected to reach £127 billion this year.

In other measures:

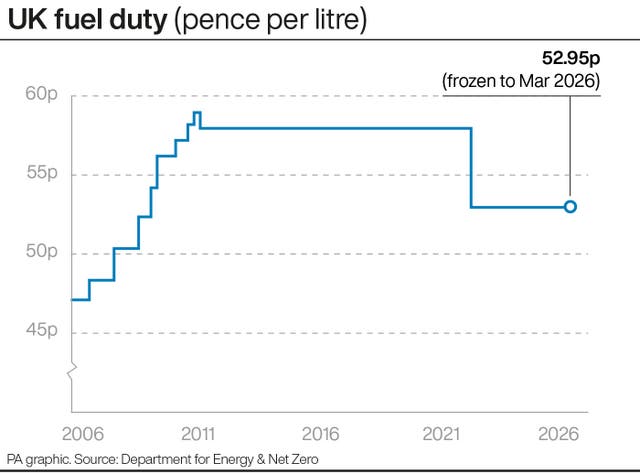

– The freeze on fuel duty will continue, including maintaining the existing 5p cut.

– A flat rate of duty will be applied on all vaping liquid from October 2026 alongside an additional one-off increase in tobacco duty to encourage people to give up smoking.

– The soft drinks industry levy will be increased to account for inflation.

– While alcohol duty rates on non-draught products will increase in line with RPI inflation, draught duty will be cut by 1.7%, knocking a penny off a pint in the pub.

– The Government will commit the funding required to extend the HS2 high-speed rail line to Euston in central London.

– There will be “over £5 billion of Government investment” in housebuilding, with £1 billion to strip dangerous cladding from buildings.

– The stamp duty land tax surcharge for second homes will increase by two percentage points to 5% from Thursday.

– The weekly earnings limit for carers allowance will rise to the equivalent of 16 hours a week at the national living wage, the largest increase since the allowance was introduced.

– Government departments will be required to meet a 2% “productivity, efficiency and savings target”.

– There will be a £22.6 billion increase in the day-to-day health budget as well as a £3.1 billion increase in the capital budget, which Ms Reeves called the “largest real-terms growth in day-to-day NHS spending outside of Covid since 2010”.

– Ms Reeves promised £1.4 billion to rebuild more than 500 schools as part of a 19% real-terms increase in the Department for Education’s capital budget, along with £2.1 billion for school maintenance.

– The Chancellor promised to save £4.3 billion a year from the cost of welfare by tackling fraud and recovering debt.