The Budget: Winners and losers

Who are the winners and losers from the Budget?

Here are some of the winners and losers from Chancellor Rachel Reeves’s Budget.

– Winners

– Minimum wage workers

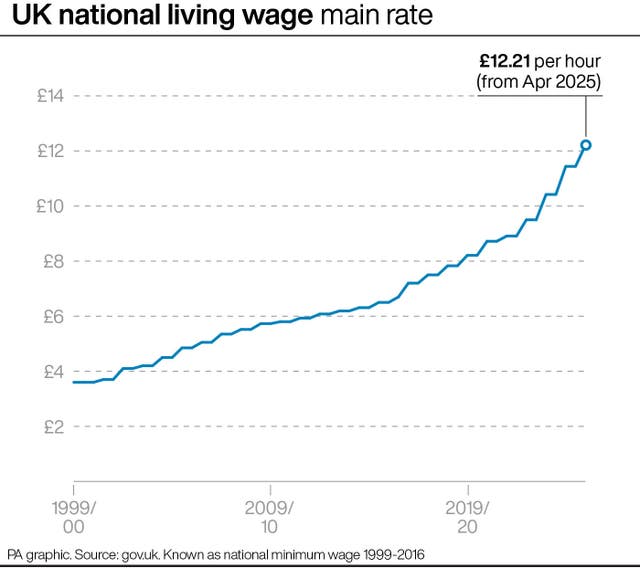

The minimum wage will rise to £12.21 an hour next year after the Chancellor confirmed a 6.7% increase.

Ms Reeves described the move as a “significant step” towards delivering on Labour’s manifesto promise to introduce a “genuine living wage for working people”.

The increase, recommended by the Low Pay Commission, will mean an extra £1,400 a year for a full-time worker earning the main minimum wage rate, known as the national living wage, from April 2025.

But it still falls short of the £12.60 per hour UK living wage calculated by the Living Wage Foundation.

The Chancellor also announced that the minimum wage for people aged 18-20 would rise to £10 an hour, an increase of £1.40.

– Carers

The weekly earnings limit for carer’s allowance will rise to the equivalent of 16 hours a week at the national living wage.

Ms Reeves said: “Carer’s allowance currently provides up to £81.90 per week to those with additional caring responsibilities.

“Today, I can confirm that we are increasing the weekly earnings limit to the equivalent of 16 hours at the national living wage per week, the largest increase since carer’s allowance was introduced in 1976.

“That means a carer can now earn over £10,000 a year while receiving carer’s allowance, allowing them to increase their hours where they want to and keep more of their money.”

– State pensioners

Ms Reeves reiterated the Government’s commitment to the pension triple lock, telling the Commons the basic and new state pension will rise by 4.1% in 2025-26.

The increase will see the weekly benefit rise to £230.30 for the full new flat-rate state pension. However, with income thresholds set to remain frozen, an individual receiving just the state pension will be taxed on their income from 2027.

The Chancellor told the Commons: “The pension credit standard minimum guarantee will also rise by 4.1%, from around £11,400 per year to around £11,850 for a single pensioner.”

– Pub-going beer drinkers

The Chancellor announced she is cutting draught beer duty to take a penny off the cost of a pint.

– Drivers

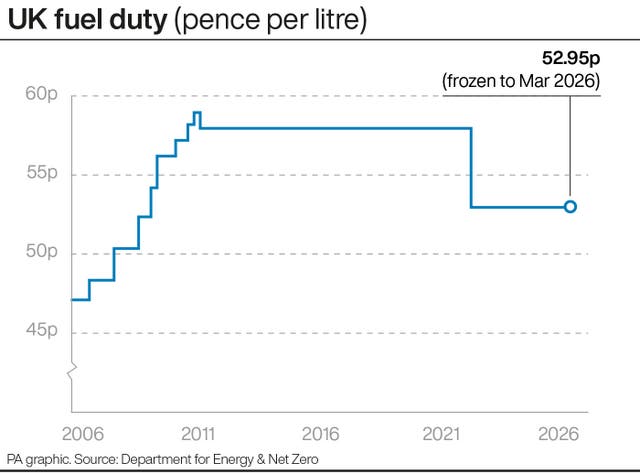

Fuel duty will be frozen next year at a cost to the Treasury of more than £3 billion.

In her Budget speech to the Commons, Ms Reeves said this is a “substantial commitment” but insisted raising taxes on fuel would be “the wrong choice for working people”.

This means the 5p-per-litre cut in fuel duty introduced by the Conservative government in March 2022 will continue.

– Losers

– Families dealing with inheritance

Inherited pension pots will be subjected to inheritance tax from April 2027 under new rules announced by the Government on Wednesday.

Alongside changes to pension pots, the Chancellor confirmed that she was extending the freeze on thresholds until 2030. The threshold freeze was due to expire in 2028.

Ms Reeves also announced that she would cap relief on the inheritance of agricultural land and family businesses, both of which can be passed on tax free under current rules.

– Employers

The Budget includes an increase in employers’ national insurance contributions by 1.2 percentage points, with Ms Reeves saying it is “the right choice to make”.

She said: “We will increase the rate of employers’ national insurance by 1.2 percentage points, to 15%, from April 2025.

“And we will reduce the secondary threshold – the level at which employers start paying national insurance on each employee’s salary – from £9,100 per year to £5,000. This will raise £25 billion per year by the end of the forecast period.

“I know that this is a difficult choice. I do not take this decision lightly.”

The Chancellor added: “Successful businesses depend on successful schools. Healthy businesses depend on a healthy NHS. And a strong economy depends on strong public finances. If the party opposite chooses to oppose this choice, then they are choosing more austerity, more chaos and more instability. That is the choice our country faces too.”

– Investors

Labour is increasing capital gains tax (CGT), in a move designed to bring in £2.5 billion over the coming years for public spending.

Ms Reeves said she will raise the lower rate of CGT to 18%, up from 10%, while the higher rate will increase to 24% from 20% previously.

CGT is charged on profit from selling an asset that has increased in value, such as stocks that are not held in an ISA, or a second home.

The tax applies to individuals, but also to company owners, partners in a business, and self-employed people, among others.

– Landlords

Second-home buyers will face a stamp duty land tax surcharge rise of two percentage points – to 5% – starting from Thursday.

Ms Reeves said: “In our manifesto, we committed to reforming stamp duty land tax to raise revenue while supporting those buying their first home.

“This will support over 130,000 additional transactions from people buying their first home, or moving home, over the next five years.”

– Smokers and vapers

Tax on hand-rolling tobacco will increase by 10% while a flat rate levy will be imposed on all vaping liquids from October 2026.

– Non-doms

Ms Reeves confirmed the Government will abolish the non-dom tax regime from April 2025.

She said: “In our manifesto we made a number of commitments to raise funding for our public services.

“First, I have always said that if you make Britain your home, you should pay your tax here.

“So today, I can confirm, we will abolish the non-dom tax regime and remove the outdated concept of domicile from the tax system from April 2025.”