UK economic growth upgraded this year amid ‘temporary boost’ from spending

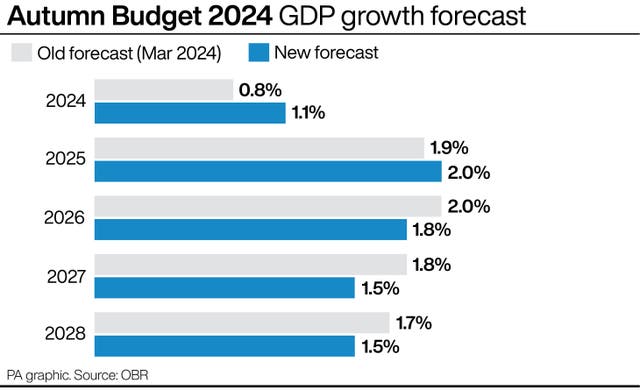

The Office for Budget Responsibility has predicted that UK gross domestic product will grow by 1.1% in 2024.

The UK economy is set to grow more than expected this year and next year partly due to a boost from the Chancellor’s significant Budget spending plans, the Government’s official forecaster has said.

However, the fiscal watchdog also reduced its economic growth projections for the longer-term as the Government increased tax measures.

The Office for Budget Responsibility (OBR) has predicted that UK gross domestic product (GDP) will grow by 1.1% in 2024.

This reflects an upgrade on its previous forecast of 0.8% and is stronger than recent projections by the Organisation for Economic Co-operation and Development (OECD) and International Monetary Fund (IMF).

The UK economy is also on track to grow by 2% next year, before a previously-predicted rise of 1.9%.

The OBR said that the fresh set of Budget policies, which will see spending increase by almost £70 billion each year, will “deliver a temporary boost to GDP”.

However, it said this positive impact will “fade to zero” within the next five years.

New forecasts also showed that the economy is expected to grow by 1.8% in 2026, 1.5% in 2027 and 1.5% again in 2028.

This represents a downgrade in expected economic growth, with the forecaster having pointed towards 2% growth for 2026, 1.8% growth for 2027 and 1.7% growth for 2028 in the previous government’s spring budget statement.

It came as the Chancellor Rachel Reeves announced a £40 billion increase in taxes, including a £25 billion raid on employers’ national insurance contributions and a rise in capital gains tax.

The OBR said tax increases would partly lead to “crowding out” of business investment, which would have 0.2% negative impact on economic growth in the medium-term.

The forecaster also said the latest financial policy measures are set to leave the Government with a buffer of £9.9 billion to balance the state finances by 2029/30.

This is significantly less than the £28 billion average headroom for previous chancellors and would not have been met were it not for new changes to its fiscal debt rules.

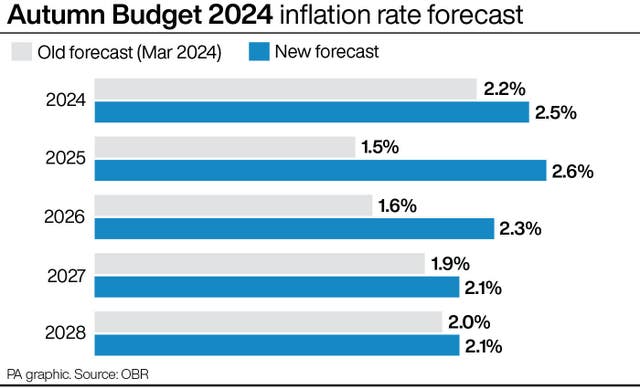

The fresh forecast also shows that UK inflation is set to be higher than expected for the next four years and remain above the Bank of England’s target rate.

Ms Reeves, delivering her first Budget, told Parliament on Wednesday that the forecaster has predicted that Consumer Prices Index (CPI) inflation will average 2.5% this year.

In its previous projections in March, the OBR pointed to 2.2% price growth for the year.

It comes despite inflation dropping to a three-year low of 1.7% in September after a sharp slump in petrol prices.

Ms Reeves also confirmed that the Government will maintain the 2% inflation target rate for the Bank of England.

The central bank cut interest rates to 5% from a 16-year high of 5.25% in August, but higher-than-expected inflation could put pressure on expectations that borrowing costs will come down further quickly.

The latest OBR forecasts also indicate that inflation will rise to 2.6% in 2025 – significantly above the 1.5% rate previously predicted.

It also increased projections for the following three years, with inflation expected to hit 2.3% for 2026, 2.1% for 2027 and 2.1% for 2028.